Protecting Financial Services and Banking Institutions

With a Game-Changing Capability, Trinity Cyber Defends the Banking and Finance Sector Customers from Ever-Increasing Attacks

Trinity Cyber protects both large and small companies across the banking and finance sector. With a keen awareness that criminals are always looking to “follow the money” – seeking large payoffs by targeting banks, credit unions, investment firms, and other financial institutions – the Trinity Cyber team understands the impact of successful cyber attacks on these institutions.

Today, cyber criminals have more tools at their disposal, enabling them to launch attacks with greater speed and efficacy.

-

The annual Verizon Data Breach Investigations Report indicates that financial institutions have experienced more breaches (477 in the most recent year) than all but one vertical, the public sector.

- The average cost of a financial service breach has grown to $5.9 million, or nearly $1.5 million more than sectors across-the-board, according to IBM.

In response, Trinity Cyber defeats threats to its banking and finance customers before they become an incident or a loss. The new Trinity Cyber capability is a powerful preventive control, unlike the detective controls offered by its competitors. By using full content inspection and taking control of the hackers techniques in network session traffic, the Trinity Cyber capability combines a more accurate form of detection with active inline prevention. Instead of focusing on bytes and packets, Trinity Cyber opens and fully inspects network traffic to accurately and reliably identify threats, tactics, and procedures. This technology is going where no other solution is going and, as a result, distinguishes itself in actively neutralizing malware and remote code exploits, and disrupting command and control (C2).

The Trinity Cyber technology is the first to open, examine, edit, and rebuild internet traffic out to the application layer inline. This rapid and precise session inspection and editing leads to real-time detection and response, profoundly improving security while dramatically reducing noise, false positives, and additional customer pain points. Trinity Cyber positions financial organizations to get ahead of the attackers with preventative results, as opposed to drowning in alerts.

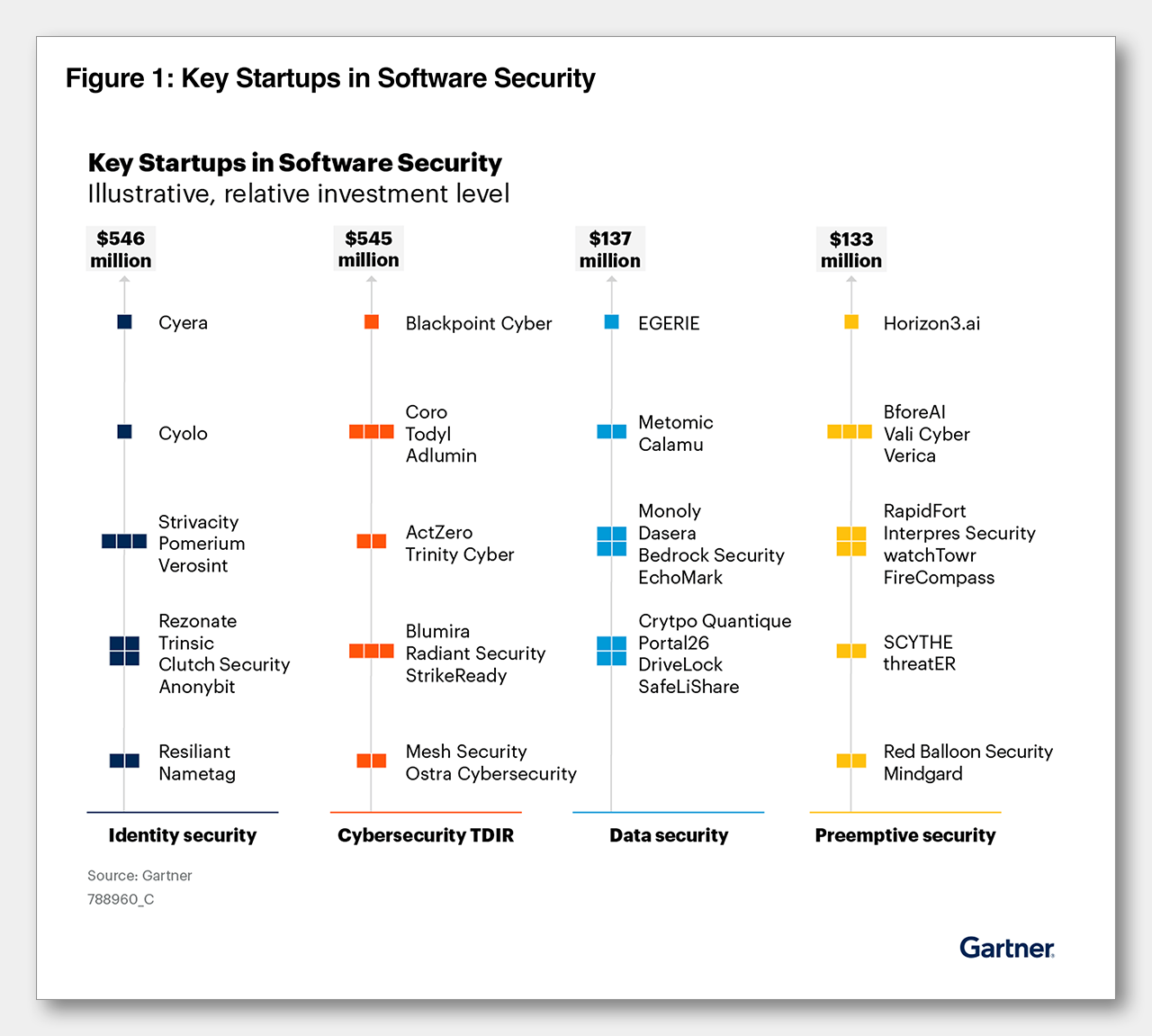

Trinity Cyber Recognized in New Gartner® Report

A New, More Proactive Threat Detection Model

A recent report from Gartner highlighted that some companies are developing “a new, more proactive threat detection model” for Threat Detection, Investigation, and Response (TDIR). It states: “The new model moves from a reactive telemetry detect, alert and respond model reliant on indicators of compromise (IOCs) to a proactive full-content inspection capability that detects and removes threats from live traffic before they enter or leave an enterprise.”

In the report, Gartner recommends: “Security product leaders must pay attention to disruptive startups to inform product roadmaps and identify new business opportunities.”

"We have invented the new essential."

-- Steve Ryan, Founder & CEO

With Trinity Cyber, financial services institutions significantly expand their defensive posture with:

- Optimal threat mitigation to go far beyond blocking and alerting

- Automated vulnerability migitation

- Reduced alert fatigue/false positives

- Zero third-party supply chain risk

At Trinity Cyber, we like to say that we do uncommon things in a sea of common solutions. What does this mean for our banking and finance customers?

- Less risk. Less risk of getting hacked. Less risk of losing data. And less compliance risk

- Speed. The Trinity Cyber technology completes the entire detection, response, and remediation cycle in a single real-time movement

- Accuracy. Because the technology is more accurate - often by 1000x - than any other network control, security teams waste less time

- Ease-of-implementation. Get it going in three simple steps … Step 1: Choose any connection option to make Trinity Cyber your path to the internet. Step 2: Accept or install a Trinity Cyber certificate. Step 3: Log into the portal … The capability and event triage are fully-managed services – considerably reducing work for security teams.

Trinity Cyber allows financial institutions to conduct the business of banking, investing, and trading with new levels of confidence in their ability to defend their networks.

If you’re not fully inspecting your traffic before it enters or leaves your enterprise, then you’re not doing everything you can to protect your network and your customers.